Introduction

Credit unions are continuously looking for new and creative ways to increase revenue and broaden their product offerings in the cutthroat financial market of today. One lucrative avenue for revenue generation is through the sale of credit cards, offering members convenient access to credit and a host of benefits. However, identifying the right members to target for credit card sales can be a daunting task. Enter Kea, an advanced AI-powered platform that is revolutionizing how Credit Unions identify and engage with potential credit card customers. In this blog, we’ll explore how Kea can assist Chief Revenue Officers in identifying target members and driving credit card sales effectively.

Understanding the Challenge

For Chief Revenue Officers tasked with driving credit card sales, the challenge lies in identifying the most promising candidates among the Credit Union’s membership base. With limited resources and a vast pool of potential customers, it’s essential to target members who are most likely to be interested in obtaining a credit card and have the means to do so. Kea the Conversational BI offers a solution by leveraging advanced data analytics and machine learning algorithms to identify target members based on specific criteria.

Leveraging Kea’s Data Insights

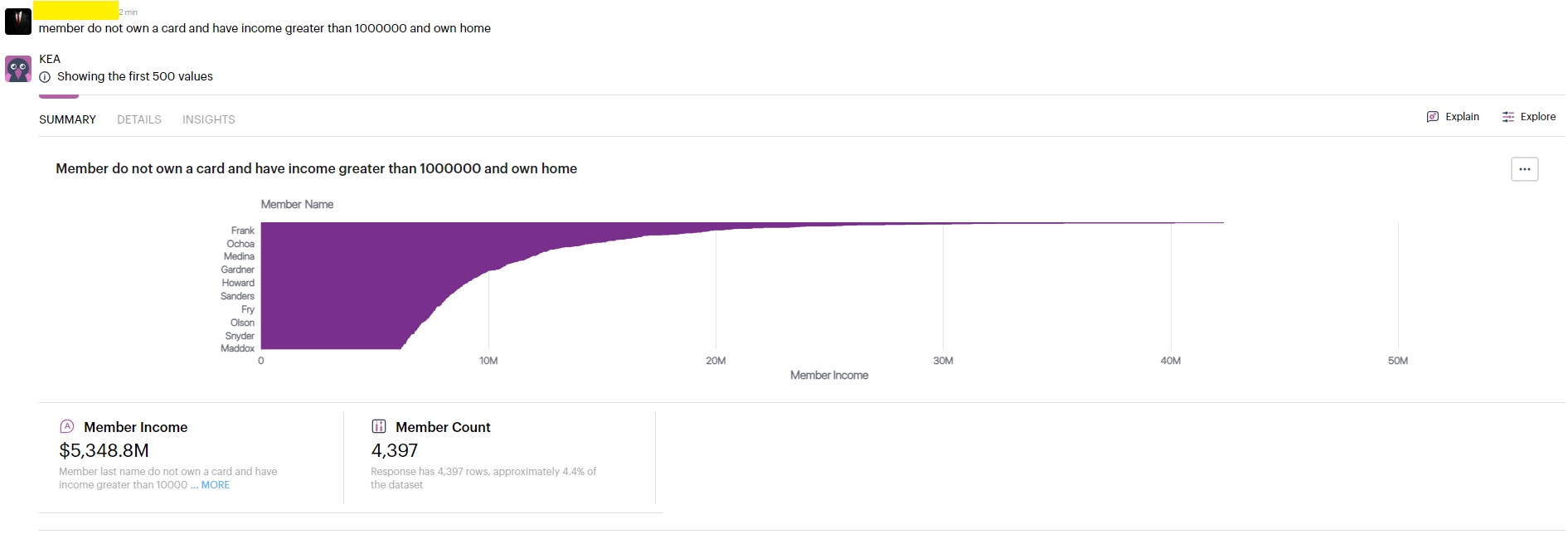

Kea serves as a powerful ally for Chief Revenue Officers by analyzing vast amounts of member data to identify potential customers. By specifying criteria such as income level, ownership of a car, and previous credit card purchase behavior, Kea can filter the membership base to pinpoint members who meet the specified criteria. This targeted approach ensures that the Credit Union’s resources are allocated efficiently to engage with members who are most likely to convert into credit card customers.

Identifying Target Members

Based on the provided criteria, Kea identifies members who have not yet purchased a credit card, have an income greater than $10,00000 per year, and own a house. These members represent a prime target audience for credit card sales, as they have the financial means to afford a credit card and may benefit from the convenience and flexibility it offers. By focusing efforts on engaging with these target members, Chief Revenue Officers can maximize the likelihood of success in driving credit card sales.

Crafting Personalized Campaigns

Armed with insights from Kea, Chief Revenue Officers can craft personalized marketing campaigns tailored to the specific needs and preferences of target members. Whether it’s highlighting the benefits of the Credit Union’s offerings, showcasing exclusive rewards and perks, or emphasizing the convenience of online account management, personalized messaging resonates with members and increases the likelihood of conversion. By leveraging Kea’s data insights, Chief Revenue Officers can create targeted campaigns that drive engagement and ultimately lead to increased credit card sales.

Deploying Multi-channel Outreach

To maximize reach and engagement, Chief Revenue Officers can deploy a multi-channel outreach strategy to connect with target members. Whether it’s through email marketing, social media advertising, or targeted direct mail campaigns, leveraging multiple communication channels ensures that the message reaches members where they are most likely to engage. By utilizing Kea’s insights to tailor messaging and channel selection, Chief Revenue Officers can optimize campaign performance and drive higher conversion rates.

Measuring Success and Iterative Optimization

Kea’s analytics capabilities extend beyond identifying target members to tracking campaign performance and measuring success. By monitoring key metrics such as conversion rates, engagement levels, and revenue generated, Chief Revenue Officers can gain valuable insights into the effectiveness of their credit card sales initiatives. This data-driven approach enables iterative optimization, allowing Chief Revenue Officers to refine their strategies, adjust messaging, and reallocate resources for maximum impact.

Conclusion

Kea offers Chief Revenue Officers a powerful tool for identifying target members and driving credit card sales effectively within Credit Unions. By leveraging advanced data analytics and machine learning capabilities, Kea enables Chief Revenue Officers to pinpoint potential credit card customers based on specific criteria and craft personalized campaigns that resonate with target members. With Kea’s assistance, Chief Revenue Officers can deploy multi-channel outreach strategies, measure success, and optimize campaign performance for maximum impact. Ultimately, Kea empowers Chief Revenue Officers to drive revenue growth and expand the Credit Union’s product offerings while delivering value to members and strengthening member relationships.