Introduction

In recent years, the banking industry has undergone a digital transformation, with the integration of advanced technologies to improve customer experience and operational efficiency. One such innovation that has gained significant traction is Conversational AI Chatbots. These intelligent virtual assistants are revolutionizing the way banks interact with customers, providing personalized support, and streamlining various processes. In this comprehensive guide, we’ll delve into the intricacies of chatbots in the banking sector, exploring key concepts, practical tips, and expert insights to navigate this evolving landscape effectively.

Chapter 1: Understanding Conversational AI Chatbots in Banking

What is Conversational AI Chatbots?

Conversational AI Chatbots are sophisticated software programs powered by artificial intelligence (AI) and natural language processing (NLP) technologies. They simulate human-like conversations with users through text or voice interactions, providing personalized assistance, answering inquiries, and performing various tasks. In the banking context, these chatbots serve as virtual assistants, helping customers with account management, transaction inquiries, product information, and more, across multiple channels including websites, mobile apps, and messaging platforms.

Evolution of Chatbots in Banking

Over the years, the evolution of chatbots in banking has undergone a remarkable evolution, driven by advancements in technology and changing customer expectations.

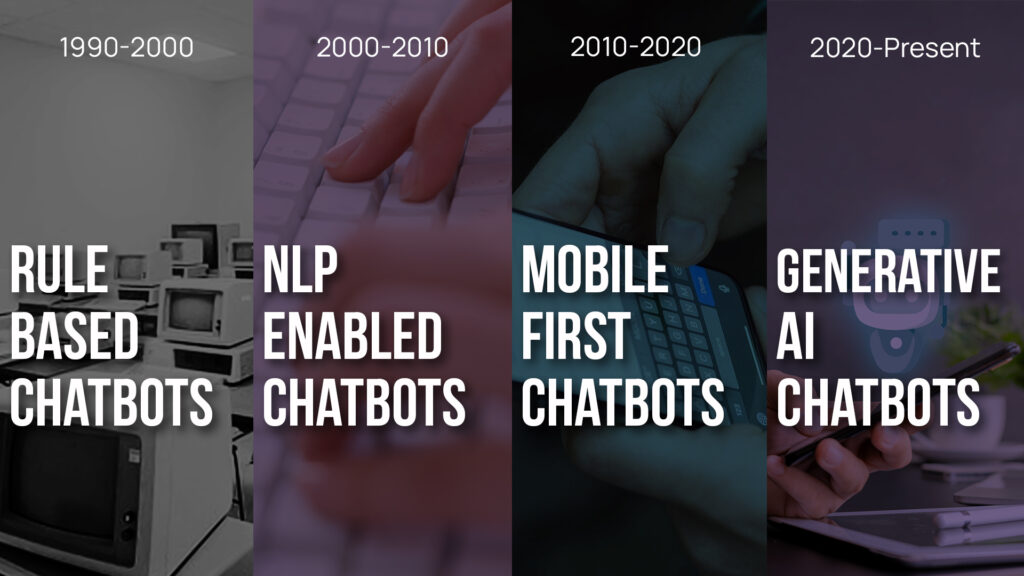

1990 – 2000: Rule Based Chatbots

In the early days, chatbots in banking were rudimentary and rule-based, primarily used for handling basic customer inquiries and providing static information. These early chatbots lacked sophistication and relied on predefined scripts to interact with users.

2000 – 2010: NLP Enabled Chatbots

As technology progressed, chatbots began to incorporate more advanced features, such as natural language processing (NLP) and machine learning algorithms. This allowed chatbots to understand user intent more accurately and provide more personalized responses.

2010 – 2020: Mobile first Chatbots

The adoption of smartphones and messaging apps spurred the popularity of chatbots in banking. Banks started integrating chatbots into their mobile apps and websites, enabling customers to perform a wide range of banking tasks, from checking account balances to transferring funds, via chat interfaces.

2020 to Present: Generative AI Chatbots

With the rise of artificial intelligence (AI) and cognitive computing, chatbots in banking have become increasingly sophisticated. Modern chatbots leverage AI-powered algorithms to analyze vast amounts of data, recognize speech patterns, and deliver contextualized responses in real-time. They can handle complex inquiries, provide personalized financial advice, and even conduct transactions on behalf of users.

Today, Conversational AI Chatbots have become an integral part of the banking experience, offering customers convenient access to banking services and support anytime, anywhere. As technology continues to advance, chatbots will likely become even more intelligent and versatile, further enhancing the way customers interact with banks and shaping the future of banking for years to come.

Benefits of Chatbots for Banks and Customers

In the dynamic landscape of banking, the integration of chatbots has ushered in a new era of enhanced efficiency and customer satisfaction. The benefits of chatbots extend to both banks and customers, revolutionizing the way financial services are delivered and experienced. From streamlining operations and reducing costs for banks to providing convenient, personalized support for customers, chatbots have become indispensable assets in modern banking.

Streamline Customer Service Operations

Chatbots streamline customer service operations by automating routine inquiries and tasks, reducing the workload on human agents. This automation helps banks optimize their resources and improve operational efficiency. By incorporating generative AI technology, chatbots can autonomously handle a wider range of customer conversations without losing the context.

Reduce Cost

By automating customer service tasks, chatbots help banks reduce operational costs associated with hiring and training customer support staff. These cost savings can be significant, especially for large banks handling a high volume of inquiries. Generative AI chatbots can scale their capabilities to handle larger volumes of inquiries without proportionally increasing costs, making them a cost-effective solution for banks.

Increase Efficiency

Chatbots can handle multiple inquiries simultaneously and provide instant responses to customer queries. This increases the efficiency of customer service operations, reducing wait times for customers and improving overall service quality. Generative AI enhancements help chatbots analyze complex inquiries and provide accurate responses in real-time.

Improve Customer Engagement and Satisfaction

Chatbots offer instant assistance and personalized recommendations, enhancing the overall customer experience. By providing timely and relevant support, chatbots can increase customer satisfaction and loyalty, leading to higher retention rates and positive word-of-mouth referrals. Through generative AI, chatbots can engage customers in more dynamic and contextually relevant conversations, fostering deeper connections and enhancing satisfaction.

24/7 Availability

Chatbots are available 24/7, allowing customers to access support and information at any time of the day or night. This round-the-clock availability ensures that customers can get assistance whenever they need it, regardless of business hours or time zones. Leveraging generative AI capabilities, chatbots can maintain their availability and responsiveness even during off-peak hours, providing consistent support to customers at any time.

Chapter 2: Implementing Chatbots: Key Considerations

In implementing chatbots in banking, several key considerations must be addressed. These considerations include

- Identifying suitable use cases

- Integrating with existing systems

- Ensuring data privacy and security

- Complying with regulatory requirements

By carefully navigating these factors, banks can effectively deploy chatbots to enhance customer service, streamline operations, and stay ahead in the competitive banking landscape.

Identifying Use Cases: Customer Service, Account Management, and More

When implementing chatbots in banking, it’s essential to identify the most suitable use cases based on customer needs and business objectives. Common use cases include customer service, account inquiries, transaction support, loan applications, and lead generation. By pinpointing specific use cases, banks can tailor their chatbot solutions to address the most pressing needs of their customers while maximizing the efficiency and effectiveness of their operations.

Integration with Existing Systems

Integrating chatbots with existing banking systems and platforms is critical to ensuring seamless communication and data exchange. This involves connecting chatbots to core banking systems, customer relationship management (CRM) platforms, databases, and third-party applications. By integrating chatbots with these systems, banks can provide customers with accurate and up-to-date information, streamline transaction processing, and facilitate frictionless user experience across channels.

Data Privacy and Security

Data privacy and security are paramount considerations when deploying chatbots in the banking sector. Chatbots interact with sensitive customer data, including personal and financial information, making it essential to implement robust security measures to protect against unauthorized access, data breaches, and cyber threats. Banks must adhere to strict regulatory requirements, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), to ensure data security and uphold trust in their services, businesses safeguard customer data diligently.

Regulatory Compliance

Regulatory compliance is another key consideration when implementing chatbots in banking. Banks must ensure that their chatbot solutions comply with relevant regulations and industry standards, such as those set forth by regulatory authorities like the Federal Reserve, the Consumer Financial Protection Bureau (CFPB), and the Financial Conduct Authority (FCA). This includes adhering to regulations related to data privacy, consumer protection, anti-money laundering (AML), and knowing your customer (KYC) requirements, among others. By staying compliant, banks can mitigate legal and reputational risks and build trust with regulators and customers alike.

Chapter 3: Enhancing Customer Experience with Generative AI Chatbots

Enhancing customer experience is a top priority for banks, and chatbots have emerged as powerful tools to achieve this goal. In this section, we explore how chatbots contribute to elevating customer experience in banking. From providing personalized assistance to ensuring round-the-clock availability, chatbots play a crucial role in delivering seamless and efficient interactions that delight customers.

Personalization and Contextual Understanding

One of the key advantages of chatbots in banking is their ability to deliver personalized experiences to customers. Through advanced analytics and machine learning algorithms, chatbots can analyze user behavior, preferences, and transaction history to provide tailored recommendations and assistance. Generative AI chatbots are equipped to generate personalized responses that mimic human-like conversations, further enhancing the sense of personalization and rapport with customers.

24/7 Availability and Instant Response

Chatbots offer round-the-clock availability and instant response capabilities, allowing customers to access banking services and support whenever they need it, without being constrained by business hours or time zones. This 24/7 availability ensures that customers receive timely assistance and information, reducing wait times and frustration. Whether it’s checking account balances, transferring funds, or resolving inquiries, chatbots can handle requests promptly and efficiently, enhancing the overall customer experience. With the aid of generative AI, chatbots can provide instant responses that are not only accurate but also dynamically generated, ensuring a seamless and engaging interaction with customers at any time of the day.

Multichannel Integration for Seamless Experience

In today’s omnichannel banking environment, customers expect a seamless and consistent experience across multiple touchpoints, including websites, mobile apps, social media platforms, and messaging apps. Chatbots play a crucial role in enabling multichannel integration by providing a unified interface for customers to interact with banking services across different channels. Whether it’s initiating a conversation on a website and continuing it on a mobile app or receiving account alerts via social media messaging, chatbots ensure a cohesive and frictionless user experience. Through the integration of generative AI, chatbots can maintain consistency in tone and language across various channels, ensuring a seamless experience for customers regardless of the platform they choose to interact with.

Language and Tone Adaptation

Effective communication is essential for building rapport and trust with customers. Chatbots must be capable of adapting their language and tone to match the preferences and expectations of different user demographics and cultural contexts. This involves employing natural language processing techniques to understand user intent, sentiment, and emotion and tailoring responses accordingly. By speaking in a conversational and empathetic manner, chatbots can engage customers more effectively and foster positive interactions, ultimately leading to higher satisfaction and loyalty. Generative AI capabilities ensure chatbots can dynamically adjust their language and tone based on contextual cues and user feedback, enabling a more natural and relatable conversational experience for customers.

Check out how ParrotGPT, our Generative AI powered Conversational Chatbot enhances customer experience.

Chapter 4: Best Practices for Chatbot Deployment in Banking Sector

Deploying chatbots in the banking sector requires careful planning and execution to ensure optimal performance and effectiveness. From designing intuitive user interfaces to implementing continuous training and improvement processes, these best practices are essential for achieving successful outcomes in chatbot deployment. By adhering to these guidelines, banks can enhance customer satisfaction, streamline operations, and drive innovation in the rapidly evolving landscape of banking technology.

Designing an Intuitive User Interface

The user interface (UI) design plays a crucial role in shaping the user experience with chatbots. When designing chatbot interfaces, banks should prioritize simplicity, clarity, and ease of use to ensure that customers can interact with the chatbot effortlessly. This involves employing intuitive navigation, clear prompts, and visual cues to guide users through the conversation flow and make it easy for them to access desired information or services.

Continuous Training and Improvement

Conversational AI Chatbots require continuous training and improvement to maintain their effectiveness and relevance over time. Banks should invest in machine learning algorithms and data augmentation techniques to continuously train chatbots on new data and feedback. By analyzing user interactions, identifying patterns, and updating the chatbot’s knowledge base, banks can enhance its accuracy, responsiveness, and ability to handle complex queries effectively.

Monitoring and Analytics for Performance Evaluation

Monitoring and analytics are essential for evaluating the performance of chatbots and identifying areas for improvement. Banks should track key performance metrics such as response time, completion rate, user satisfaction, and conversion rate to assess the effectiveness of their chatbot solutions. By leveraging analytics tools and dashboards, banks can gain valuable insights into chatbot performance, user behavior, and trends, enabling them to make data-driven decisions and optimize the chatbot experience.

Human-Agent Collaboration for Complex Queries

While chatbots excel at handling routine inquiries and tasks, there are instances where human intervention is necessary, particularly for complex or sensitive queries. Banks should implement seamless handoff mechanisms between chatbots and human agents to ensure a smooth transition when escalation is required. This human-agent collaboration enables banks to leverage the strengths of both chatbots and human agents, providing customers with the best possible support and resolving inquiries efficiently.

Chapter 5: Future Trends in Chatbots and Banking

The future of chatbots in banking holds immense promise for transforming the industry. In this section, we explore the emerging trends and advancements that are shaping the trajectory of chatbots in banking. From advancements in natural language processing (NLP) to the integration of voice assistants and the expansion of chatbots beyond customer service, these future trends are poised to revolutionize the way banks interact with customers and deliver financial services. By staying abreast of these developments, banks can position themselves at the forefront of innovation and drive meaningful change in the banking landscape.

Advancements in Natural Language Processing (NLP)

Advancements in natural language processing (NLP) technology are driving significant improvements in chatbot capabilities, enabling more accurate language understanding, sentiment analysis, and conversational interactions. As NLP algorithms continue to evolve, chatbots will become increasingly proficient at understanding and responding to user queries in natural language, facilitating more engaging and personalized interactions with customers. This enhanced linguistic intelligence will pave the way for more sophisticated chatbot applications in banking, including smart virtual assistants capable of handling complex inquiries and providing personalized financial advice.

Integration of Voice Assistants and Voice Recognition

The integration of voice assistants and voice recognition technology with chatbots is poised to transform the way customers interact with banking services. Voice-enabled chatbots allow users to engage in natural language conversations using voice commands, making banking transactions and inquiries more convenient and accessible, especially for users with limited dexterity or visual impairments. As voice recognition technology continues to improve in accuracy and reliability, voice-enabled chatbots will become an integral part of the banking experience, offering hands-free access to a wide range of financial services and information.

Expansion of Chatbots Beyond Customer Service

While chatbots initially gained traction as customer service assistants, their scope is expanding beyond traditional support functions to encompass a broader range of banking services and applications. Banks are exploring new use cases for chatbots, including sales and marketing, product recommendations, financial planning, and personalized banking services. By leveraging chatbots across various business functions, banks can enhance customer engagement, drive revenue growth, and differentiate themselves in a competitive market landscape. As chatbot technology continues to mature, we can expect to see an increasing number of innovative applications and use cases emerge, further cementing chatbots’ role as indispensable tools in the banking industry.

Generative AI the Next Frontier in Chatbots

Generative AI can generate human-like responses and engage in more dynamic and contextually rich conversations with users. By leveraging deep learning algorithms and large datasets, generative AI chatbots can simulate human-like language and behavior, offering a more immersive and personalized user experience. As the technology matures, generative AI chatbots hold the potential to revolutionize customer interactions in banking, enabling more natural and intuitive communication between customers and virtual assistants.

Conclusion

In the ever-evolving landscape of banking, Conversational AI Chatbots stand out as powerful tools reshaping customer service and operational efficiency. From understanding their evolution to implementing best practices, this guide has provided invaluable insights into leveraging chatbots effectively.

By integrating chatbots seamlessly, prioritizing security and compliance, and embracing innovation, banks can enhance customer engagement and drive business growth. As technology continues to advance, chatbots will play a pivotal role in delivering personalized, efficient, and accessible banking experiences.

The journey towards the future of banking is fueled by the transformative potential of Generative AI. Let’s embrace this opportunity to innovate and redefine banking for the digital age, creating lasting value for customers and organizations alike.