Business Value Achieved

The business value enjoyed by the insurer in bancassurance is detailed below.

- Policy issuance turnaround time reduced from 7 days to 7 minutes.

- Increased insurance product sales by 30% through the bank channels.

- Detailed Status tracking and updates to user and customer.

The Client – A Leading Insurance Provider

Our client is a leading service provider in the Indian health insurance sector with more than 17 years of experience having a national presence handling 1000+ branch offices. The client aims to be the largest health insurance provider ensuring financial security for healthcare management for the average Indian.

- Industry – Insurance sector

- Employee Strength – 13,000+

- Solution – Integration with Banks through a digital channel for onboarding to policy issuance

The Context – Enhancing Insurance Sales through Banks

Banks are always a place for the commerce of financial products. Whether it’s personal finance or the complex financial operations of a large-scale business, banks were always looked at as a place where customers were given the best possible advice. In straightforward terms, a serious capital for banks was the trust their customers place in them.

Insurance sales as an activity heavily depended on field agents with a complex process involving multiple human touch points. Many times the field agents’ interaction with the customer was limited to upselling, cross-selling, and post-sales service calls which can range from premium payment reminders to collection after maturity.

However, if you look at the other end of the spectrum banks banked on building relationships with customers on multiple levels which covers the entire portfolio of personal finance. This opened up a new world for insurance providers, where they envisioned the improvement of sales through banking channels tapping into the relationship banks had with their customers. Definitely, the chance of an insurance sale conversion was more with a bank officer and thus the concept of bancassurance was born. The advantages of banks as a channel are numerous, and a few of them are:-

- Customer Relationship: A bank officer would interact with the customer more frequently. As mentioned above, trust proved to be a valuable currency in the banking business.

- Customer Convenience: The multifaceted approach from the banks which ranged from investments to insurance, was a win-win for the customer where he had a one-stop shop for all his financial trifles.

- Customization: Banks had end-to-end knowledge of customer requirements, hence they would be able to suggest customized insurance products

- Customer Database: Banks had a varied customer portfolio and insurance providers had easy access to them

The Case – Amplify Insurance Sales through Digital Channel

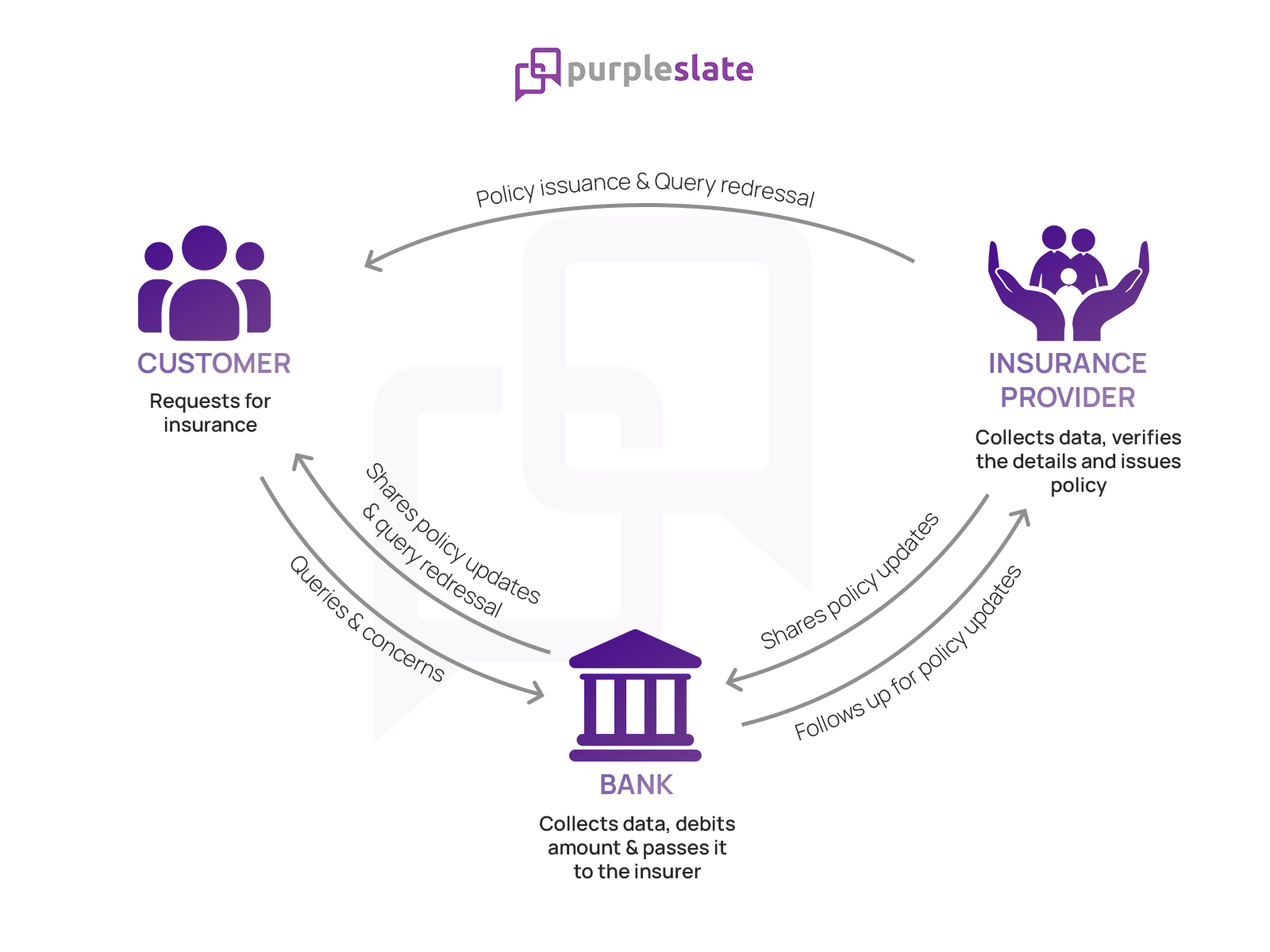

There was a key gap in using banks as a channel (Bancassurance). The turnaround time for policy issuance and document sharing with the customer took 7 days as this was a physical process that involved the following responsibilities.

From the Bank’s perspective:-

- Data Collection: Special officers in the banks had to collect end-to-end data of the customer to be shared with the insurance company branch.

- Debit Amount: Once the data was collected, the officers had to debit the amount from the customer.

- Inform Branch: After debiting the amount, officers had to inform the insurance partner’s nearest branch of the collected details.

- Track Updates: After handing over the information, the special officers needed to continuously follow up with the branch for policy status updates.

- Support: Any immediate queries and concerns of the customer regarding the policy were addressed by special officers

From the Insurance Org’s perspective:-

- Data Collection: Relationship managers in the branch had to collect, catalog, and store customer data from the bank.

- Validate Details: Relationship managers had to validate the customer details, check the proposal amount, and process the payment.

- Issue Policy: Once the payment was processed, the policy documents had to be issued

- Update Status: Relationship managers had to proactively update the status to the banks regarding policy issuance.

- Support: Any queries or concerns from the bank or customer had to be addressed in priority.

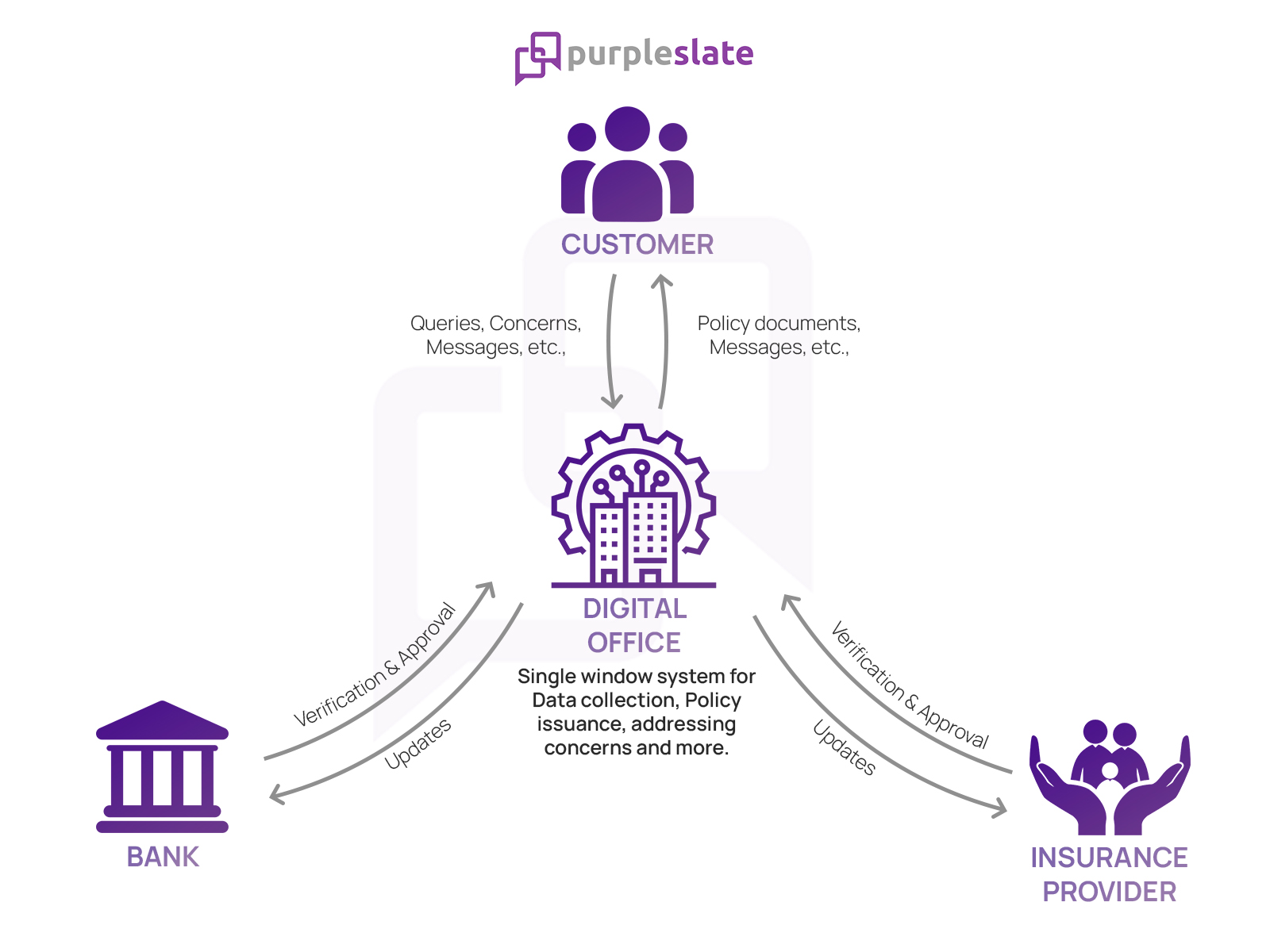

We at purpleSlate identified the gap and proposed the entire process to be integrated through our digital office solution and giving access to special officers in partner banks, who handle the entire process from the client side.

Interested to read about the Digital Office Solution? Click here!

The advantage of digitizing the journey for bancassurance was many, but the most important facet was its e-onboarding capabilities.

Through an e-KYC authentication facility, special officers could collect and verify the basic credentials of the proposers once they accept the quote, instead of demanding them to fill out the physical documents. Intermediaries could also obtain confirmation of consent from the proposers through an OTP verification initiated from the portal.

The entire process control of approving and sharing the policy documents was given to both the special officer in the banks and relationship managers in the insurance organization which significantly brought down the time of approval and policy issuance from 7 days to 7 minutes (even lesser)

The Benefits – Improved Service to Customers

Now banks are able to provide the insurance documents way faster.

- Digitization: Through the Digital Office, we digitized the entire journey of the customer including sending the relevant documents in a digital format.

- Shared responsibilities: With the Digital Office, both the special officers in banks and relationship managers can verify e-KYC, approval, concern redressal, and policy issuance.

- Improved insurance sales: The reduced turnaround time for insurance approval improved the number of conversions and helped special officers achieve their targets.

- Single window system – Banks and insurance providers need not switch between multiple systems to capture customer details. This also reduced the effort in duplicating information between two systems.