Introduction

InsurTech has become a powerful driver of change in the insurance sector. There’s a lot of potential for technology to transform this industry and automate repetitive and time-consuming tasks. There are several recent developments in the tech world and some of the interesting innovations are taking place in insurance.

McKinsey forecasts that InsurTech will bring in a revenue of more than USD 150 billion between the period 2025 – 2030. For any insurer, this is the right time to strategize and optimize digital assets for the future. Here are some of the important tech trends that will unlock a variety of new opportunities for the insurance industry.

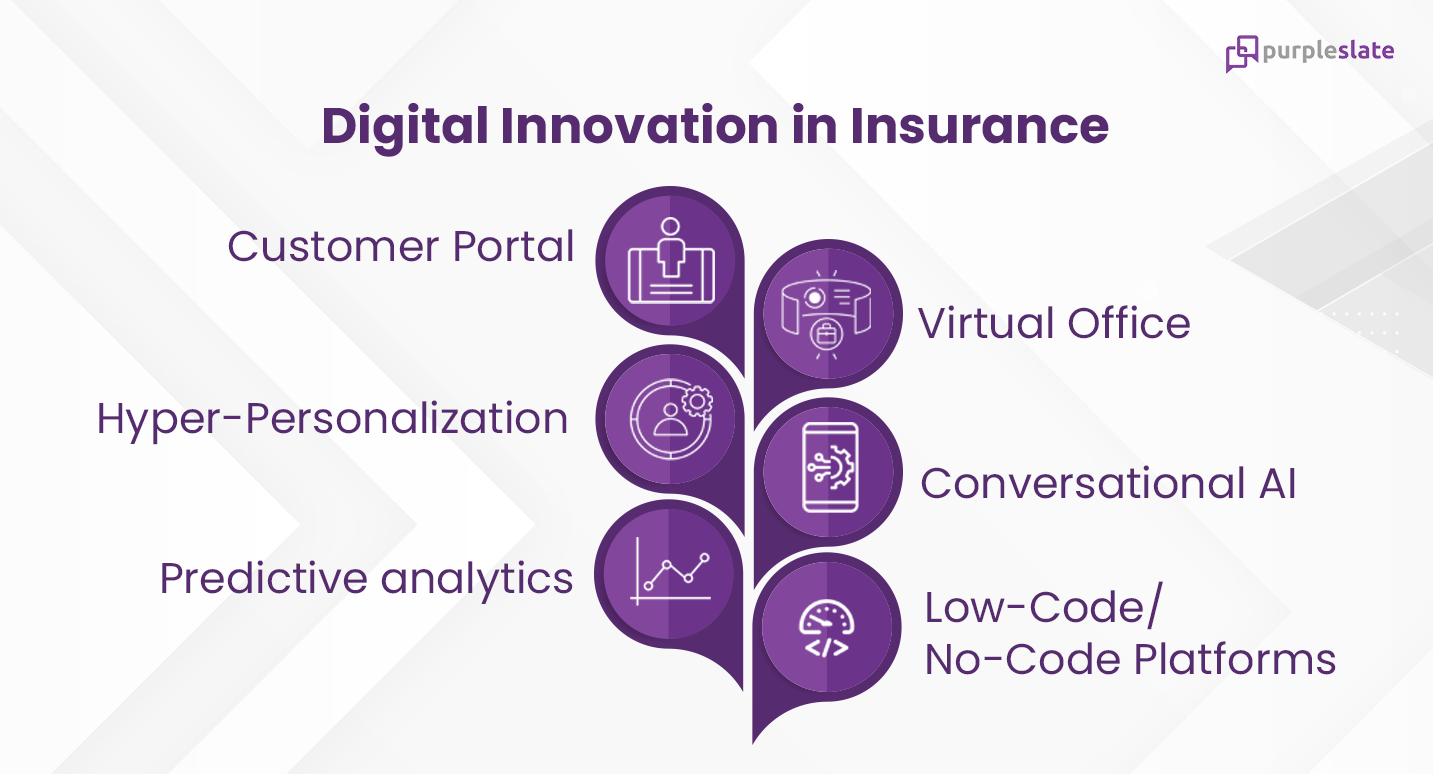

Customer Portal

Imagine, Joe, a 30-year-old man with a median income, purchases a family health premium for the first time. One day, one of his family members falls sick in the middle of the night and he decides to submit a claim. His knowledge about submitting claims is still minimal. He waits till morning to call his insurance provider and waits again for the company to release the forms and questionnaires. He finishes his paperwork and finally submits a claim. After buying insurance, customers like Joe are dependent on either their agents or the insurance firms when they need to invoke any kind of action, such as submitting a claim, or for any further information.

With a self-service customer portal, customers can access any information they need or invoke any action they want all by themselves, allowing autonomy over the products or services they have paid for. This way, customers don’t have to call customer service or contact their agents in moments of need. With a user-friendly portal specifically made for them, customers can submit proofs straight away, apply and keep track of their claims processing at their convenience, renew their policies, and much more.

Apart from this, a carrier’s knowledge base is a practical mandatory tool in a customer portal. Customers can access this repository of information, compare insurance plans and make the best policy-related decisions all by themselves. A knowledge base could include resources such as policy comparisons, a glossary of legal terms, claims application guides, education about potential risks as well as informative articles and videos.

Virtual Office for Agents

A virtual office allows agents to perform business-centric tasks using near real-time customer data and interactive workflows that complement the intricacies of the insurance practice. Independent agents are incredibly busy and deal with a myriad of tasks every day. From finding potential customers to renewals, they are single-handedly responsible to perform all of their time-sensitive tasks. There is the risk of losing customers if they don’t keep track of their engagements. To top it all, there are also loads of paperwork to be done.

With a virtual office, agents can keep track of all of their business essentials – customers, transactions, and much more – with a detailed dashboard. This dashboard can also provide a comprehensive view of an agent’s entire lead lifecycle and help them capture leads automatically, easily track lead activities, qualify and nurture them into customers. With this feature, insurance agencies can oversee their agent activities, and the revenue they bring in.

With a simple integration with the business CRM, agents and service teams can access a 360 view of a customer. This enables them to provide the right advice, identify and pitch any up-selling or cross-selling opportunities, customize offerings, and so on. Apart from customers, these dashboards can give a comprehensive 360 view of agent activities. Agents can receive insights into their performance and areas of improvement in order to reach their financial goals.

Omnipresent Conversational AI

Conversational AI solutions can help improve customer experience and enhance customer satisfaction by automating conversations. As per the Salesforce State of Chatbots Report, 69% of consumers prefer to use chatbots because of the speed and ease of communicating with the brand.

A smart conversational AI can act as a digital agent for an insurer’s customers. One of the key incentives for insurance brands to implement Conversational AI solutions is its omnipresence. With the help of Conversational AI, brands can be available to customers at all times and provide a seamless experience every time they interact with them.

66% of global consumers agree that social media platforms have become credible sources for them to discover and research products & services before they invest in them. With a truly omnipresent Conversational AI, customers can easily access brands through whichever medium they find convenient such as their official web page, mobile apps, SMS, automated IVR telephony, and even social media like WhatsApp, Facebook, and Instagram.

Typically, insurance agents would need to invest a lot of time and effort in answering these routine queries. With a chatbot working anywhere and anytime, insurance agents and insurers alike can invest their time and effort entirely in more crucial and high-value work, such as handling more complex customer queries from prospects and working on retaining clients.

Low-code/No-code

A report says that 40% of insurers are looking for solutions that can significantly reduce underwriting and claims management costs. With out-of-the-box solutions that require low-code/no-code, insurance companies today can automate tedious manual processes in no time. More work can happen in less time since low-code solutions can be similarly built for processes such as billing, underwriting, claim submissions, quotes, and much more.

One of the biggest challenges faced by insurers today is moving beyond their complicated legacy systems. Legacy platforms accumulated over the years have created interdependencies among different systems, thus forming a web that is tedious to get rid of. Older technologies have created silos, making it difficult for cross-functional teams to work together to serve customers. In such scenarios, low-code platforms offer a breather by accelerating the building of solutions and enabling migration in phases.

APIs, databases, plugins, third-party services, etc. – most low-code platforms today allow integration with anything. With open API frameworks, insurance products are immediately ready for integration with other systems, distribution channels, customer portals, agent virtual offices, and more. This way, low-code platforms can help in seamlessly integrating with core systems and data sources instead of replacing the existing technology.

Hyper-Personalization

Hyper-personalization includes the usage of real-time data on a large scale and predictive analysis to retrieve better information thereby, enabling better products/services. With the aid of technology and data analysis, hyper-personalization can create an insightful, dynamic, and responsive customer experience.

With data at its core, hyper-personalization involves looking at the consumers closely and understanding what exactly they need. Then, delivering a product/ service that caters to these specific needs.

For instance, with the help of hyper-personalization tools, insurers can customize an insurance policy for a low-risk profile as opposed to building a similar policy for higher-risk cases. The factors can vary from risk profiles, monthly income, assets, and data collected from wearable IoT devices among others. Resultantly, insurers can then adjust the premiums on a case-to-case basis.

Apart from this, hyper-personalization also enables insurance providers to identify and reduce the risk of fraud before it happens and allows space for the implementation of corrective measures in real-time.

A hyper-personalized approach will help in offering a customer policy based on a grounded reality and predictable changes. This not only benefits the customers. For insurance companies, it benefits them by enabling them to configure policies that are feasible as well as policies that are most likely to sell.

Predictive Analytics

Traditionally, policy pricing followed a tiered approach where insurers would adjust the customer against specifications that they deemed them fit. However, as personalization takes the center stage, one can no longer follow the one-size-fits-all model.

With predictive analytics in underwriting, insurers can now customize policy plans by tapping into granular customer data. They can gain insights by analyzing historical data to understand customer preferences, price sensitivity, and behavioral signals. For instance, predictive underwriting in life insurance can help insurers match the policy specifications and cost in line with the expectations of the customers.

Predictive analytics software can collect customer data to extract behavioral information that can correlate with fraudulent or high-risk activities. It can flag down suspicious customer patterns and alert insurance agencies in real-time. Insurance agencies can also use it to tackle internal fraud and application manipulation. It serves as a forensic tool that points towards fraud.

Apart from this, when it comes to boosting the customer experience, the use of predictive analytics in insurance is far-reaching. For instance, predictive analytics-driven automation can streamline the claims settlement process and make it painless, and also help comprehend user intent when they approach customer service and much more.

Conclusion

Today, we live in an era of rapid technological revolution that is changing the way insurers prepare for the unforeseeable. As we put more trust into technology and value its use, insurance companies are implementing innovative technologies to increase productivity and solve inefficiencies.

For example, with the expansion in robotics, multiple insurers are assessing whether drone technology can be leveraged as a terrific alternative to traditional claims inspection.

In cases of natural calamities like hurricanes, drone technology can provide an accurate and expansive inspection process while minimizing the health hazard that claims adjusters have to expose themselves to.

This corroborates that insurers will continue to embrace AI, ML, drones, robots, and other technologies as companies find new uses for them. To understand how we apply our digital capabilities to insurance operations, get in touch with our team of experts today.