Categories

- Analytics Glossary

- Artificial Intelligence

- Back To Basics

- Blogs

- Books

- Business Intelligence

- Case Studies

- Case Study Summary

- Chatbots

- ChatGPT

- Conversational AI

- Conversational Insights

- Conversational Insights Glossary

- Culture

- Data Analytics

- Data Engineering

- Data Management

- Data Quality

- Data Science

- Data Visualization

- Deep Work

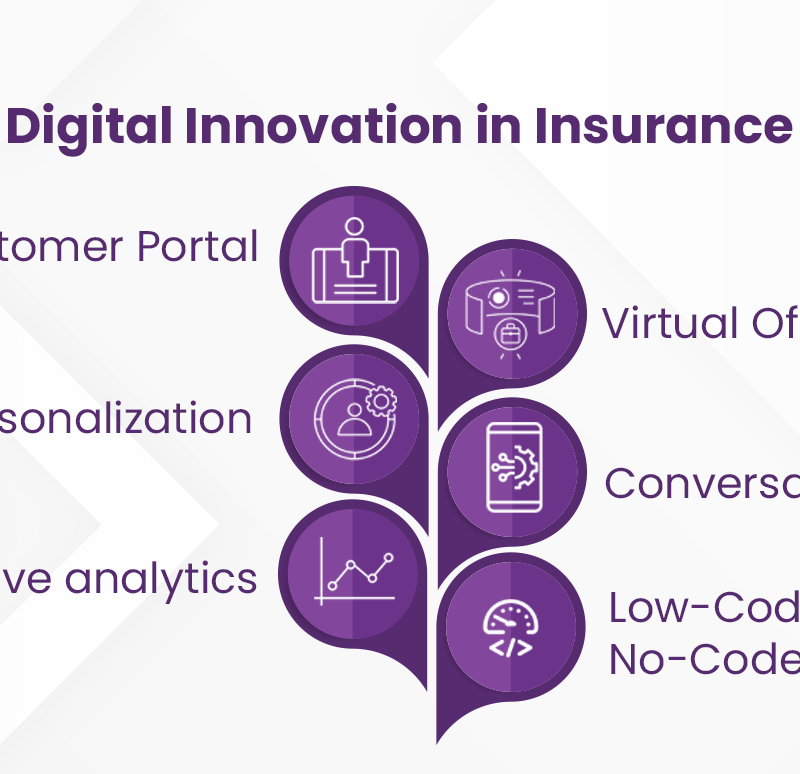

- Digital Transformation

- Disruption

- Education

- Events

- Future

- Generative AI

- Guide

- Innovation

- Inspiration

- InsurTech

- LLM

- Org Culture

- Politics

- Practice

- Talent

- Technology

- Upcoming Events